Maintaining Utah's competitive edge and quality of life requires the state to proactively manage and address the multiple demands being placed on limited resources—the taxpayer dollar. Utah's growing and changing population and new dynamics in its revenue streams place an increased demand on everything from infrastructure to education and from natural resources to corrections.

overview

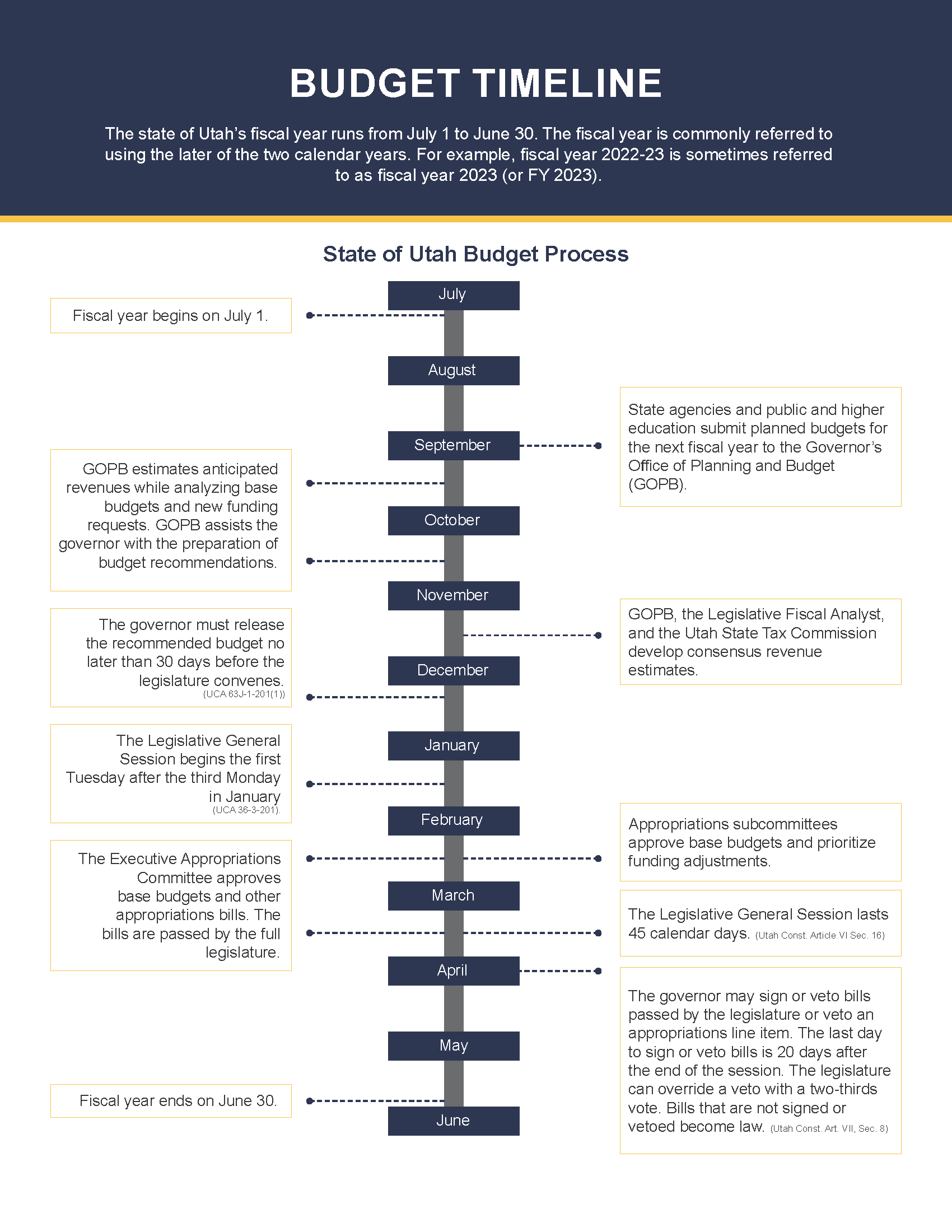

The state of Utah’s fiscal year runs from July 1 to June 30. The fiscal year is commonly referred to using the latter of the two calendar years. For example, fiscal year 2024-2025 is sometimes referred to as fiscal year 2025 or FY 2025.

Prior to legislative general sessions, the governor proposes a budget to the legislature. Under the state’s Budgetary Procedures Act, “The total appropriations requested for expenditures authorized by the budget may not exceed the estimated revenues from taxes, fees, and all other sources for the next ensuing fiscal year.”

The state’s enacted budget is the sum of all items of appropriation contained in legislation. Because the state budget is a representation of appropriations (authorization to expend funds), the state budgets on modified accrual basis, consistent with how government funds are reported in the Annual Comprehensive Financial Report (ACFR). Items of appropriation authorize expenditures and include the following: the name of the agency and line item to which authorization is granted; and the sources of finance from which authorization is granted; and the amounts authorized. Items of appropriation also may include a schedule of programs; intent language; approved full-time equivalent employment; authorized capital outlay; and other conditions of appropriations.

REVENUE COLLECTIONS

The Governor’s Office of Planning and Budget (GOPB), Office of the Legislative Fiscal Analyst (LFA) , and the Utah State Tax Commission gather and analyze revenue collection data on a monthly basis. The Monthly State Revenue Snapshot, which summarizes state revenue collections, can be found at the link below.

REVENUE FORECAST

Each November, the Governor’s Office of Planning and Budget (GOPB), Office of the Legislative Fiscal Analyst (LFA),and the Utah State Tax Commission engage in a consensus process to forecast state revenue collections for the current and upcoming fiscal years. These forecasts are based on economic indicator projections provided by the state’s Revenue Assumptions Working Group, which includes economists and field experts from the GOPB, LFA, Utah State Tax Commission, Utah Department of Workforce Services, University of Utah, and other representatives.

The governor’s budget recommendations are based on the November revenue consensus forecasts. These forecasts are also updated during the legislative general session and inform legislative budgeting decisions. Consensus revenue estimates are published on the Utah Treasurer’s Office Budget and Information website and meeting materials for the legislature's Executive Appropriations Committee (EAC) website when revenue estimates are adopted. Additional information on the economic indicators that inform revenue forecasts is included on GOPB’s websites for Policy & Economic Analysis Reports and Policy & Economic Analysis Dashboards.

After the budget is enacted, GOPB, LFA, and the Utah State Tax Commission gather and analyze revenue collection data on a monthly basis.

BUDGET PREPARATION

Each year, officials from public education, higher education, and state agencies submit two items to GOPB: planned expenditures for their base budget and budget change requests. Common budget requests include costs associated with population growth, inflationary increases, and federal mandates. GOPB works with agencies to develop budget proposals that drive the best investment and use of Utah’s resources.

After analyzing anticipated revenues, base budgets, and new budget requests, GOPB assists the governor in preparing final budget recommendations. The governor’s budget recommendations are summarized in the governor’s budget recommendation book and online content. The governor delivers his budget message and transmits his budget recommendations to the legislature through the legislature’s staff budget office, LFA.

BUDGET APPROVAL AND ADOPTION

Thirty days prior to each general legislative session, the LFA, by statute, receives the governor’s budget recommendations. The LFA is required to review this executive budget before the legislature convenes and to make recommendations and comments to the legislature on each item or program.

To enact law, including a budget bill, the legislature must pass an identical bill in both the House of Representatives and the Senate.

Utah is unique in that the appropriations committee is composed of the entire legislature that is divided into joint House and Senate appropriations subcommittees by topic, such as Public Education, Higher Education, Social Services, etc. After the LFA receives the governor’s budget recommendations, it analyzes the recommendations and prepares its own recommendations for the legislature and its appropriation subcommittees.

The appropriation subcommittees analyze the budgets within their assigned topic area and submit their final recommendations to the EAC. EAC receives the recommendations from the joint appropriations subcommittees, makes final budgetary decisions to balance the budget, and directs the LFA to prepare appropriations bills. The appropriations bills are debated and the House of Representatives and the Senate pass the budget bills.

Budget Implementation and Execution

After the legislature passes the budget bills, the governor decides whether or not to sign the bills. Once a bill is signed by the governor, it goes into effect on the date specified in the bill. State agencies use the funding provided to them in the budget to carry out their responsibilities.

The LFA prepares an appropriations report annually that summarizes the actual enacted budget. The report and other legislative budget materials are available on https://budget.utah.gov. Details on agency budgets, missions, and programs are available in the LFA’s Compendium of Budget Information (COBI).

Since the state of Utah only appropriates one-time revenues and balances for one-time purposes, it is common for the governor's recommended budget and the enacted budget to hold back available one-time funding in one fiscal year so it can be used for one-time uses in a future fiscal year. A summary of sources, uses, and unappropriated balances from the General Fund, Income Tax Fund, and Uniform School Fund is displayed in Table 3. A similar table is typically provided in Table 11 of the Budget of the State of Utah after the budget is enacted.

Besides the unappropriated General Fund, Income Tax Fund, and Uniform School Fund balances carried over from FY24 to FY25, the governor's FY25 budget recommendations do not anticipate any significant change in fund balances compared to the end of FY23 fund balances. A list of FY23 balances by fund is available in the FY23 Fund Balance Report. Additional summaries of FY23 fund balances are available in the FInancial Highlights and ACFR available on the Division of Finance Financial Reports website.